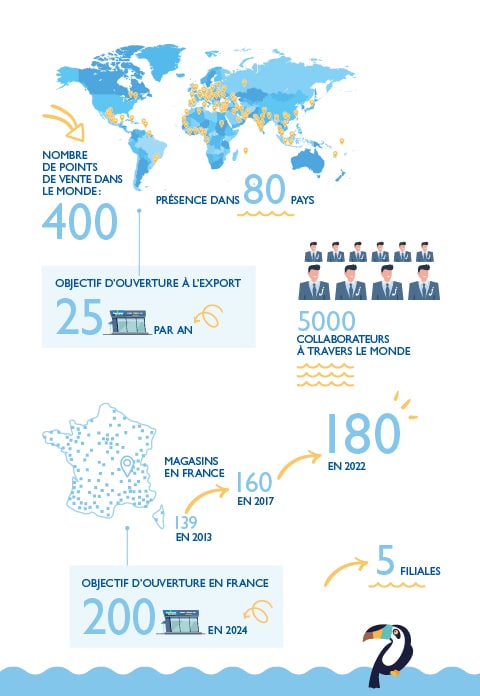

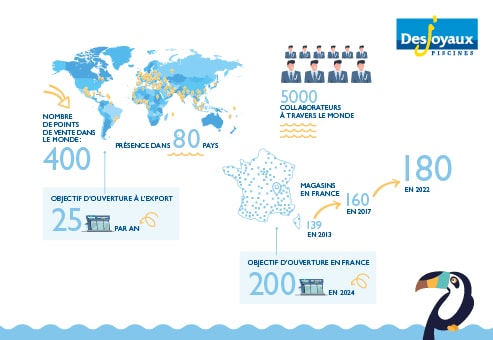

Founded in 1966, Piscines Desjoyaux is the world’s leading in-ground pool builder, with 180 exclusive concessions in France and a presence in 80 countries. It is the inventor of two major concepts: pipeless filtration and permanent active formwork. With nearly 25 million euros of investment planned for its sole production site over the next 24 months, this family-run business continues its commitment handed down from generation to generation.

Maintenance.

Jean-Louis Desjoyaux, when you published record results for 2020/2021, you said you hoped to continue this trend and improve the Group’s profitability. Is this still possible, despite cost inflation?

“We are more cautious given the inflationary and geopolitical context. However, we remain confident in our ability to deliver slightly higher sales in 2021/2022 thanks to equipment sales, which remain buoyant.”

Does this mean that fewer basins will be sold this year? Does the trend differ from country to country?

“We thought we’d manage to maintain the number of pools sold at the record level of 2020/2021, i.e. 13,000.

However, the weather was less than favorable last summer, the elections and the war in Ukraine with its inflationary effects weighed on the pool market in France and throughout Europe at the start of 2022. Fortunately, the very favorable weather in May boosted traffic to our site and dealerships, and we saw a 39% increase in the number of contacts in May compared with the previous year.”

What impact will inflation have on profitability?

“We have reincorporated into our sales prices, which have risen by 10% since October, all costs incurred in absolute terms by our dealer customers, so that our gross margin has been preserved. As our operating costs remain under control, our earnings will remain very high this year.”

New products, diversification, external growth… where could the surprise come from at Desjoyaux?

“As in the past, we remain focused on our exclusive products. We are continuing to invest to bring certain parts in-house, in order to reintegrate added value and be less dependent on our suppliers, particularly Chinese. In terms of products, we’re still working to complete the range by offering entry-level in-ground pools. While our kit pool project has not yet come to fruition, we are planning to launch, within the next 18 months, 3 to 4 models of small pools incorporating our traditional filtration unit, reserving our new system for larger basins. Three new countries have been added: Madagascar, Senegal and Libya.

What investment envelopes are you planning for the coming years?

“Continuing to forecast annual growth of 10% over the next few years, we have entered a major investment phase of around €25 million spread over 2022 to 2024, compared with a normal annual investment of around €7 million. With a view to integrating the value chain, 10 M€ will be invested in an injection press and 3-4 M€ in molds. The remainder of the budget will be devoted to real-estate investments: doubling our extrusion unit, a new sorting center, a new R&D center, a new refectory for our staff and a new loading dock. ”

The Group has a strong cash surplus net of financial debt, and has doubled its dividend payout to €9.1 million. How do you plan to allocate this surplus capital over the next few years?

“We do not plan to pay an exceptional dividend: our annual payout policy will be linked to earnings. We prefer to accumulate room for maneuver in anticipation of any difficult years ahead, even if today we see the potential for growth, particularly in Germany and Italy, where our network is still far from complete.”

Article published on ZONE BOURSE on 10/06/2022

Raphaël Girault